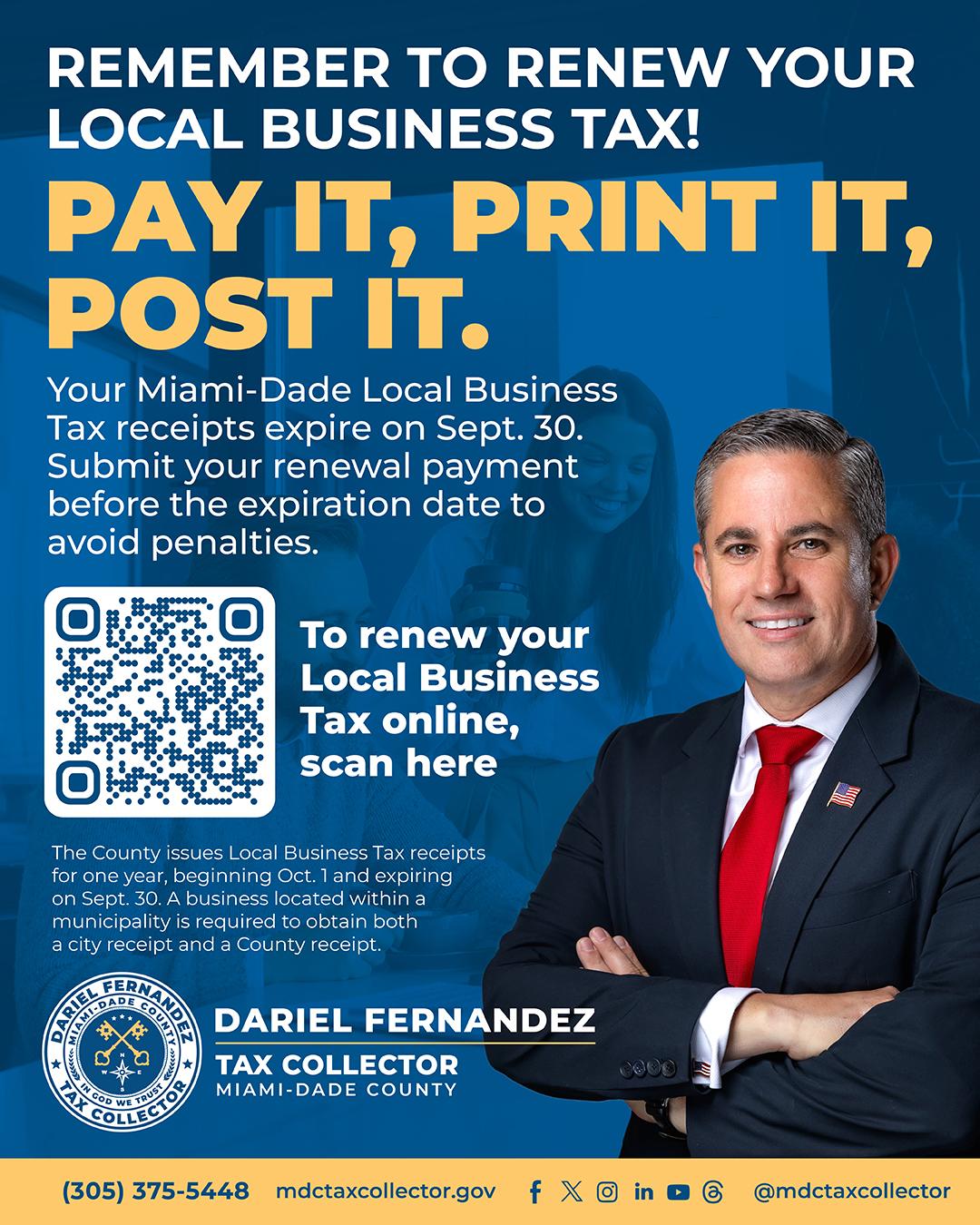

Pay It, Print It, Post It: Your Tax Collector Dariel Fernandez, Reminds you that It Is Time to Renew Your Local Business Tax

The Miami-Dade County Tax Collector’s Office reminds all business owners that Local Business Tax (LBT) receipts expire on September 30. Renewing your business tax receipt on time is the best way to avoid penalties and keep your operations compliant with county regulations.

Why Renewal Matters

Every business operating in Miami-Dade is required to maintain a valid Local Business Tax receipt. This receipt serves as proof that your business is registered and authorized to operate for the fiscal year beginning October 1 and ending September 30. Failure to renew before the deadline can result in late fees and penalties that impact your bottom line.

Easy Ways to Renew

We’ve made the renewal process simple and convenient:

- Online Payments: Scan the QR code on your renewal notice or visit mdctaxcollector.gov to submit your payment quickly and securely.

- In-Person Service: Visit any of our eight Tax Collector locations across Miami-Dade County to complete your renewal. Our team is ready to assist.

Print It, Post It

Once your payment is submitted, don’t forget to print your updated Local Business Tax receipt and post it in a visible place at your business. This step is not only required by law but also reassures your customers and partners that your business is properly licensed.

City and County Receipts

If your business is located within a municipality, you may need both a city receipt and a county receipt. Be sure to check your requirements to stay in compliance.

A Message from Tax Collector Dariel Fernandez

“Miami-Dade businesses are the backbone of our local economy. By renewing your Local Business Tax on time, you help us continue to provide vital services to our residents while keeping your business in good standing,” said Miami-Dade County Tax Collector Dariel Fernandez.

Need Help?

For more information about your Local Business Tax renewal or to find your nearest office, call (305) 375-5448 or visit mdctaxcollector.gov.