Tax Collector Dariel Fernandez Clarifies Property Tax Payment Procedures for Miami-Dade Residents

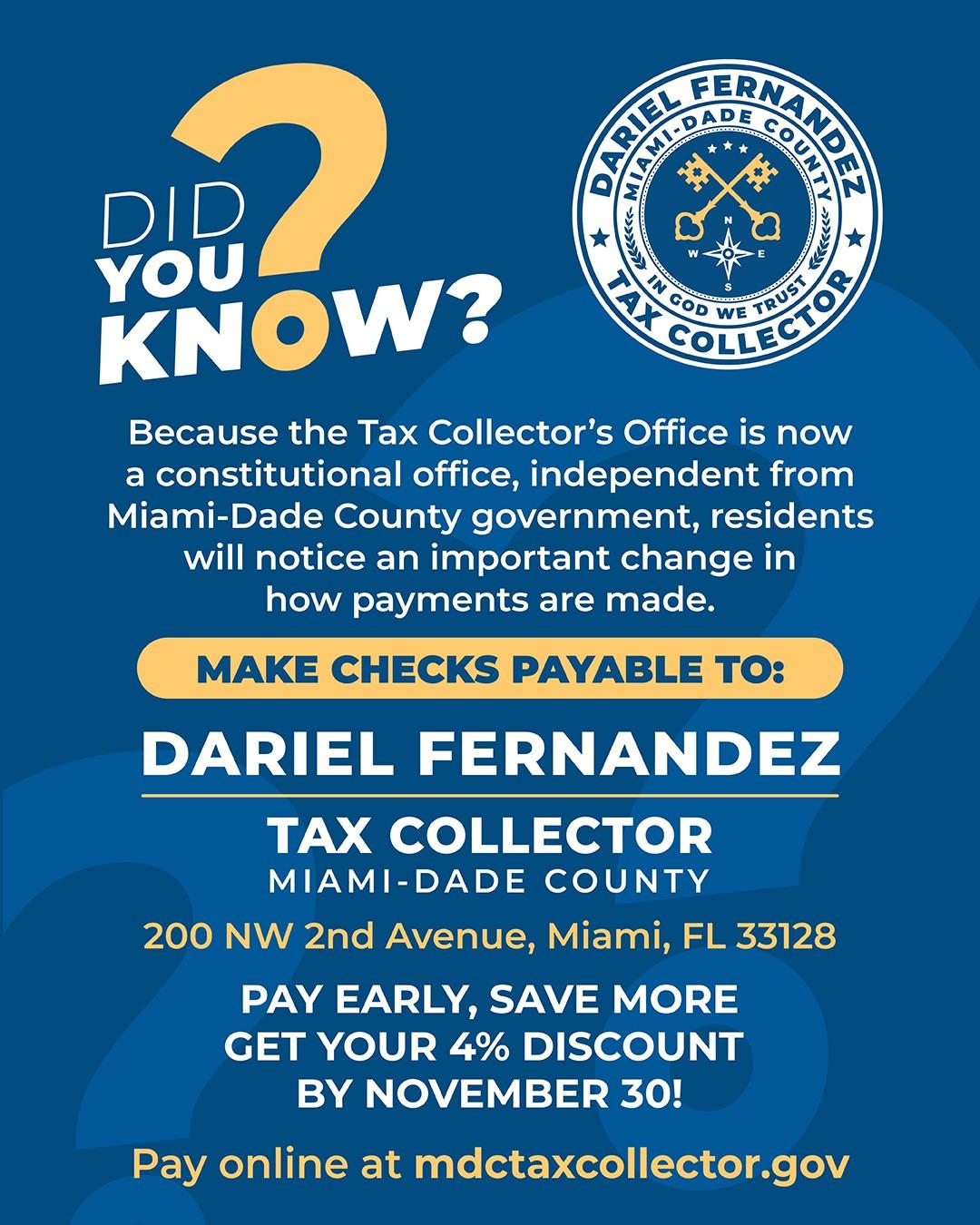

As the Miami-Dade County Tax Collector’s Office begins its first year operating as an independent constitutional office, Tax Collector Dariel Fernandez is addressing questions from residents about how property tax payments should now be made.

In accordance with Florida Statute §197.332, each county Tax Collector in the State of Florida is responsible for collecting taxes on behalf of state and local governments. Because the Miami-Dade County Tax Collector’s Office is now an independent entity, all checks and money orders must be made payable to the elected Tax Collector by name and title.

All property tax payments should be made to:

Dariel Fernandez

Tax Collector, Miami-Dade County

200 NW 2nd Avenue

Miami, FL 33128

This procedure is required by law and ensures that every payment is safely deposited into the official government account of the Miami-Dade County Tax Collector’s Office, not to any individual personally.

“Our goal is to make this process clear, secure, and transparent,” said Tax Collector Dariel Fernandez. “We understand that any change in procedure can be confusing, especially for our seniors. That’s why our team is here to answer questions and assist every resident who needs guidance.”

The Tax Collector’s Office remains fully committed to providing clarity, transparency, and assistance to all residents throughout this transition.

For questions or support, residents can visit mdctaxcollector.gov or call the customer service team at (305) 375-5448.